Last updated: January 25, 2026

Key Takeaways

- SaaS-expert agencies outperform generalists by focusing on subscription metrics like MRR, churn reduction, and Net New ARR, achieving 71% year-over-year growth versus 10% for poor unit economics.

- Flat-fee pricing between $1,250 and $5,750 per month aligns incentives better than percentage-of-spend models, which can inflate CAC by 180%.

- Revenue-focused KPIs such as LTV:CAC at 3:1 and payback under 12 months, combined with CRM integration, reveal true business impact instead of vanity metrics like clicks and impressions.

- Tactics such as competitor conquesting and B2B-specific CRO deliver 65% lower cost per qualified lead and 40% MQL-to-SQL conversion rates.

- SaaSHero demonstrates these advantages with proven case studies; schedule a discovery call with SaaSHero to transform your SaaS marketing.

5 Criteria That Clearly Separate SaaS-Expert and Generalist Agencies

1. SaaS Specialization and Vertical Knowledge

SaaS-specialized agencies understand subscription businesses in detail. They work daily with customer lifetime value calculations, churn prevention, expansion revenue, and product-market fit in marketing messages. Generalist agencies often apply one-size-fits-all strategies across industries, which weakens results for SaaS-specific challenges.

|

Aspect |

SaaS Expert Pros/Cons |

Generalist Pros/Cons |

|

Focus |

Deep B2B SaaS expertise in churn and CAC control / Limited to SaaS niche |

Broad industry experience / Thin SaaS-specific knowledge |

|

Performance Impact |

71% year-over-year growth for high NRR and short payback / Dependent on SaaS market health |

Flexible across verticals / Weak fit for SaaS unit economics |

Companies with high Net Revenue Retention and short payback periods achieve 71% year-over-year growth, compared to just 10% for those with poor unit economics. SaaS-expert agencies such as SaaSHero prove this specialization through case studies like TestGorilla, which reached an 80-day payback period that supported a $70M Series A raise.

2. Pricing Models and Incentive Alignment

Pricing models reveal an agency’s real priorities. Percentage-of-spend models reward higher ad spend even when efficiency drops. Traditional percentage models can inflate CAC by 180% because agencies chase higher fees instead of better outcomes.

|

Model |

SaaS Expert (e.g., SaaSHero) |

Generalist |

|

Fee Structure |

$1,250 to $5,750 flat monthly tiers, no spend dependency |

10% to 20% of ad spend, revenue tied directly to client spend |

|

Contract Terms |

Month-to-month flexibility with shared risk |

Six to twelve month lock-ins that protect agency revenue |

|

Incentive Alignment |

Efficiency-focused recommendations, must re-earn business each month |

Incentive to inflate spend, contracts shield poor performance |

Flat-fee models keep budget recommendations grounded in performance data instead of agency revenue needs. Month-to-month agreements increase accountability and push agencies to deliver consistent results to retain clients.

3. Metrics, Reporting, and Revenue Connection

Metrics priorities show how well an agency understands SaaS economics. Eighty percent of SaaS companies still focus on vanity metrics like traffic, clicks, and MQLs instead of SQLs and revenue impact, which breaks the link to real business outcomes.

|

Metric Category |

SaaS Expert |

Generalist |

|

Primary KPIs |

Net New ARR, SQL conversion rates, CAC payback period |

Impressions, clicks, CTR, total leads |

|

Attribution |

CRM integration that tracks revenue outcomes, with more complex setup |

Last-click Google Analytics, simple but often inaccurate |

|

Reporting Focus |

Pipeline contribution and LTV:CAC ratios, tied directly to revenue |

Activity metrics and engagement rates, disconnected from business results |

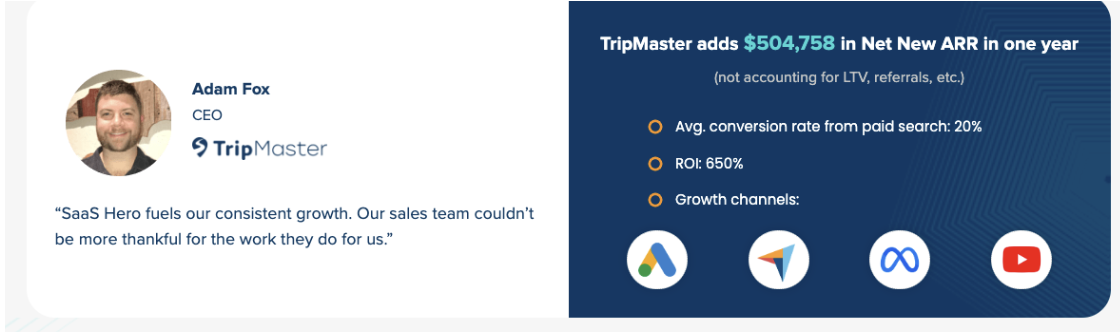

SaaS companies should target LTV:CAC ratios of 3:1 or better and CAC payback periods under 12 months. SaaS-expert agencies connect to CRM systems to track these numbers, while generalists often rely on platform data that hides true impact. SaaSHero’s TripMaster case study illustrates this approach, with $504,758 in tracked Net New ARR.

Book a discovery call to explore revenue-focused reporting that connects marketing to closed revenue.

4. SaaS-Specific Tactics and Campaign Execution

SaaS-expert agencies use tactics built for B2B software buyers. Competitor conquesting targets users who actively research alternatives. Heuristic conversion rate optimization supports complex, multi-stakeholder B2B buying journeys.

B2B SaaS companies that implement conquesting strategies achieve 65% reductions in cost per qualified lead by targeting competitor brand searches with tailored messages that address known pain points.

|

Tactic |

SaaS Expert Approach |

Generalist Approach |

|

Competitor Targeting |

Intent-based conquesting with comparison landing pages |

Generic brand awareness campaigns |

|

Conversion Optimization |

Heuristic CRO tailored to B2B buying committees |

A/B testing focused on single-step conversions |

|

Lead Qualification |

Scoring based on SaaS buyer behavior signals |

Basic demographic and firmographic filters |

Enterprise B2B SaaS companies using advanced lead scoring reach 40% MQL-to-SQL conversion rates, which nearly triples the generic benchmark of 12% to 21%. This tactical depth improves pipeline quality and boosts sales efficiency.

5. Team Structure, Access, and Transparency

Team structure shapes execution quality and daily collaboration. Many generalist agencies suffer from a bait-and-switch pattern, where senior strategists sell the account and junior staff handle delivery.

|

Structure Element |

SaaS Expert Model |

Generalist Model |

|

Account Management |

Senior-led teams with a maximum of 8 to 10 clients per manager |

Junior execution teams with 20 or more clients per manager |

|

Communication |

Embedded in client Slack or Teams channels |

Monthly email reports and quarterly calls |

|

Strategy Development |

Strategists stay involved in day-to-day execution |

Strategy handoff to a separate execution team |

SaaS-specialized agencies keep lower client-to-manager ratios because B2B SaaS campaigns need constant refinement based on sales feedback and product changes. This focus ensures that strategic decisions carry through to tactical execution without dilution.

Why SaaSHero Stands Out for B2B SaaS Teams

SaaSHero follows the SaaS-expert model across all five criteria. Their flat-fee pricing between $1,250 and $5,750 per month removes incentives to inflate spend, and month-to-month contracts keep performance under constant review. The agency focuses exclusively on B2B SaaS, which builds deep vertical expertise across HR Tech, Transit Software, and Real Estate Tech.

Case studies highlight this focus. TestGorilla reached an 80-day payback period. TripMaster generated $504,000 in Net New ARR. Leasecake supported a $3M funding round with efficient pipeline growth. These outcomes show consistent alignment with SaaS unit economics.

SaaSHero’s operating model integrates directly into client teams through Slack channels and CRM systems. This setup creates visibility that generalist agencies rarely match while they juggle diverse portfolios. The mix of specialization, aligned pricing, and transparent execution positions SaaSHero as a strong choice for B2B SaaS companies that want sustainable, efficient growth.

Book a discovery call to see how a SaaS-expert agency can improve your marketing ROI.

Frequently Asked Questions

What defines real SaaS expertise in a digital marketing agency?

SaaS expertise means a deep grasp of subscription business models and recurring revenue dynamics. It covers churn prevention, customer lifetime value growth, and the complex B2B buying process. Expert agencies track Net New ARR, CAC payback periods, and Net Revenue Retention instead of only traditional marketing metrics. They also understand free trials, product-led growth, and expansion revenue, which many generalist agencies overlook.

How do SaaS agencies differ from generalist agencies?

Key differences span five areas. Specialization favors vertical focus over broad coverage. Pricing favors flat fees over percentage-of-spend models. Metrics focus on revenue outcomes instead of vanity metrics. Tactics emphasize competitor conquesting and SaaS-specific CRO instead of generic campaigns. Team structures rely on senior-led execution instead of junior-heavy delivery. SaaS agencies prioritize subscription outcomes, while generalists reuse cross-industry playbooks.

What is the typical retainer for a SaaS marketing agency?

SaaS marketing retainers usually range from $1,250 to $7,000 per month, depending on ad spend and scope. Specialized agencies often use tiered flat-fee models instead of percentage-of-spend pricing. Agencies managing up to $10,000 in monthly ad spend might charge $1,250 to $2,500. Teams handling $50,000 or more in spend can charge up to $7,000 per month for full-service support. Percentage-based models often create misaligned incentives and higher CAC.

How can I avoid agency bait-and-switch on my account?

Ask for senior-led account management and confirm low client-to-manager ratios, ideally a maximum of 8 to 10 clients per strategist. Meet the actual team members who will run your campaigns, not only sales staff. Favor agencies that offer month-to-month contracts instead of long-term lock-ins, because flexible terms encourage continuous performance and reduce complacency.

Which metrics should I track to judge SaaS agency performance?

Track revenue-connected metrics such as Net New ARR, SQL-to-closed-won conversion rates, CAC payback periods, and pipeline contribution by channel. Aim for LTV:CAC ratios above 3:1, payback periods under 12 months for SMB SaaS, and MQL-to-SQL conversion rates above 20%. Avoid agencies that focus mainly on impressions, clicks, or total lead volume without tying those numbers to closed revenue.

Conclusion: Why a SaaS-Expert Partner Matters for 2026

The choice between SaaS-expert and generalist marketing agencies shapes your 2026 growth trajectory. The five criteria of specialization, pricing alignment, metrics focus, tactical expertise, and team structure expose major differences in approach and outcomes. With CAC rising and payback periods extending, you need a partner that understands SaaS unit economics to maintain sustainable growth.

SaaS-specialized agencies such as SaaSHero deliver clear advantages. Flat-fee pricing aligns incentives. Revenue-focused metrics connect campaigns to business outcomes. SaaS-specific tactics generate qualified pipeline efficiently. Generalist agencies often chase their own revenue through percentage-based fees and highlight vanity metrics that hide real performance.

Evidence across case studies shows that specialized expertise drives stronger results. Companies that work with SaaS-expert agencies reach faster payback periods, higher conversion rates, and more efficient customer acquisition. As capital efficiency becomes critical in 2026, a partner fluent in ARR, churn, and LTV provides a meaningful competitive edge.

Start your move toward efficient and accountable marketing growth. Book a discovery call with SaaSHero’s team to see how focused SaaS expertise can improve your marketing ROI and support durable growth.