Last updated: January 25, 2026

Key Takeaways

- In-house SDR teams cost $200k+ per rep each year and need 6-9 months to ramp, which fits mainly $50M+ ARR companies.

- Traditional agencies charge 10-20% of ad spend and focus on vanity metrics, which often misaligns with SaaS revenue goals.

- SaaS-focused partners like SaaSHero use flat $1,250-4,500 monthly retainers, ramp in 2-4 weeks, and connect directly to your CRM.

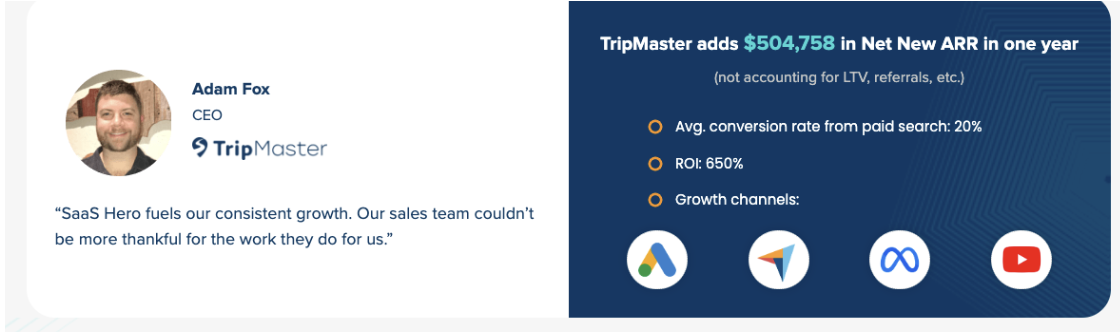

- Real outcomes include $504k Net New ARR for TripMaster and an 80-day payback period for TestGorilla using hybrid models.

- Choose SaaSHero for proven B2B SaaS growth and schedule a discovery call to improve your lead generation strategy.

How B2B SaaS Lead Generation Models Work

B2B SaaS lead generation sits in a complex environment with multi-touch attribution and average sales cycles of 84 days. Three main models dominate this space.

In-House SDR Teams: Companies hire and manage their own sales development reps and carry full responsibility for performance. This approach usually requires $200k+ per junior SDR each year when you include salary, benefits, tools, and management overhead.

Traditional Lead Gen Agencies: External partners run campaigns using percentage-of-spend pricing. They often require 6-12 month contracts and focus on vanity metrics such as impressions and click-through rates.

Specialized SaaS Growth Partners: Hybrid models like SaaSHero blend agency execution with in-house style collaboration. They use flat monthly retainers and revenue-based reporting so incentives stay aligned with client growth.

Eight Criteria to Compare Lead Generation Models

Smart lead generation decisions look beyond headline cost and consider impact on revenue, risk, and speed. The table below compares the three approaches across core factors that shape SaaS growth.

|

Criteria |

In-House Team |

Traditional Agency |

SaaS-Focused Partner |

|

Setup Cost |

$100k+ (6-9 months) |

$5k-15k |

$1k-2k |

|

Monthly Cost |

$16k+ per SDR |

10-20% of ad spend |

$1,250-4,500 flat |

|

Ramp Time |

6-9 months |

2-4 weeks |

2-4 weeks |

|

Expertise Level |

Variable |

Generalist |

SaaS-specialized |

Research Sources Behind These Benchmarks

This analysis uses multiple 2025-2026 industry reports and vetted case studies. Key data sources include Lureon’s B2B SaaS Lead Generation Report, DigitalBloom’s Pipeline Performance Benchmarks, and results from specialized SaaS growth partners.

The research includes outcomes from companies such as TestGorilla, which reached an 80-day payback period, and TripMaster, which generated $504k in Net New ARR through refined lead generation strategies. All financial metrics reflect market conditions as of January 2026.

In-House SDR Teams: Full Cost and Ramp Profile

Building an internal SDR team creates high upfront investment and ongoing operational costs that extend far beyond base salaries.

In-House SDR Cost Breakdown

Personnel Costs: Average US SDR compensation ranges from $39,000 to $77,000 including base salary, commission, and bonuses. Entry-level SDRs average $45,676 each year, while experienced reps can reach $75,000.

Hidden Expenses: Recruitment averages $4,129 per employee, and training adds about $1,678 per hire. The tech stack often includes CRM licenses at $50-135 per user, phone systems at $100-500 per extension, and additional sales enablement tools.

Turnover Impact: SDR churn rates stay high, and replacement costs can reach 150-200% of annual salary. This pattern creates constant recruiting and training cycles that push total investment even higher.

In-House SDR Ramp Timeline

Internal SDR teams typically need 6-9 months to reach full productivity. This period covers recruitment for 1-2 months, onboarding for 1 month, training for 2-3 months, and performance tuning for another 2-3 months. During this time, companies carry full costs while generating limited pipeline.

Best Fit: In-house SDR teams work best for companies with $50M+ ARR that can handle long ramp times and have strong sales leadership to guide team development.

Traditional Lead Generation Agencies: Speed with Tradeoffs

Conventional agencies launch quickly but often miss on SaaS-specific needs and incentive alignment.

How Traditional Agencies Operate

Pricing Structure: Most agencies charge 10-20% of monthly ad spend, which rewards higher budgets regardless of performance. This structure often conflicts with efficient customer acquisition.

Contract Terms: Standard 6-12 month agreements shift most risk to clients and reduce pressure on agencies to deliver consistent results.

Reporting Focus: Many agencies highlight impressions, clicks, and CTR instead of pipeline, SQLs, or revenue.

Challenges With Traditional Agencies

The common “bait-and-switch” pattern appears when senior strategists sell the engagement, then junior account managers run campaigns. Many agencies lack B2B SaaS expertise and struggle with churn, MRR, LTV, and complex attribution.

Best Fit: Traditional agencies suit companies that want fast campaign launches and already have internal leaders to own strategy and performance.

SaaS-Specialized Growth Partners: Hybrid Advantage

SaaS-focused partners solve many agency drawbacks while still moving faster than in-house teams.

How SaaSHero Works With SaaS Teams

Pricing Transparency: SaaSHero uses flat monthly retainers from $1,250 to $4,500 based on ad spend tiers. This structure removes percentage-of-spend conflicts. Month-to-month agreements lower client risk and keep accountability high.

Revenue-Focused Reporting: Direct CRM integration supports tracking of Net New ARR, pipeline value, and sales-qualified leads instead of surface-level engagement metrics.

Embedded Team Model: SaaSHero joins client channels such as Slack and Google Chat and provides dedicated account management with senior strategy oversight.

Results From SaaS-Specialized Engagements

Case studies show clear outcomes. TestGorilla reached 80-day payback periods while raising a $70M Series A. TripMaster generated $504k in Net New ARR with 650% ROI. Playvox cut cost per lead by 10x and increased lead volume by 163%.

Teams that want similar results can book a discovery call and review specific goals, budgets, and timelines.

Lead Gen Recommendations by SaaS Stage

The right lead generation model depends on company stage, budget, and internal skills.

Bootstrapped Startups ($500k-2M ARR): SaaS-focused partners usually provide the strongest risk-adjusted returns. The $1,250 per month entry tier delivers expert management at a fraction of in-house cost and keeps flexibility high.

Growth-Stage Companies ($2M-10M ARR): Hybrid models perform well during rapid scaling. Revenue-based reporting supports board updates and investor conversations, while month-to-month terms allow quick budget shifts.

Scale-Up Organizations ($10M+ ARR): In-house teams make sense when strong sales leadership and proven unit economics already exist. Many successful companies still keep hybrid setups and rely on specialized partners for channel depth while building internal strategy.

2026 Trends: AI-Driven Hybrid Lead Gen

The 2026 lead generation market continues to move toward hybrid setups that mix human expertise with AI support. High-growth B2B SaaS companies increasingly use hybrid talent models with core full-time teams for strategy and flexible specialists for execution.

AI-first hybrid methodologies reduce cost per lead by 40-60% within six months and improve lead quality through deeper prospect research and smarter campaign adjustments.

Lead Generation Decision Checklist

The checklist below helps teams compare options and pick a model that fits budget, risk, and reporting needs.

|

Factor |

In-House |

Traditional Agency |

SaaS Partner |

|

Budget Flexibility |

High fixed costs |

Variable with spend |

Predictable flat rate |

|

Speed to Market |

6-9 months |

2-4 weeks |

2-4 weeks |

|

Risk Tolerance |

High upfront |

Contract lock-in |

Month-to-month |

|

Reporting Needs |

Full control |

Vanity metrics |

Revenue tracking |

Why SaaS-Focused Partners Win in 2026

The 2026 B2B SaaS environment rewards lead generation models that support capital efficiency and clear revenue ownership. In-house teams offer maximum control but carry long ramp times and high costs, which fit mainly larger organizations. Traditional agencies move fast but often lack SaaS depth and aligned incentives.

Specialized SaaS growth partners create a strong middle path. They combine agency speed and channel expertise with revenue-focused accountability and flexible terms. Case studies with 80-day payback periods and hundreds of thousands in Net New ARR show how effective this hybrid approach can be.

The priority is choosing a partner that understands B2B SaaS unit economics, shares pricing transparently, and integrates smoothly with your team. Book a discovery call to review how a focused lead generation strategy can speed up your path to sustainable, profitable growth.

Frequently Asked Questions

What is the true cost gap between in-house SDRs and specialized agencies?

In-house SDR teams often require $200k+ each year per representative when you include salary, benefits, tools, training, and management overhead. This figure does not include 6-9 month ramp times or turnover costs that can reach 150-200% of annual salary. Specialized SaaS agencies such as SaaSHero start at $1,250 per month with near-immediate deployment, which stays far more cost-effective for companies under $50M ARR.

Which lead gen model fits Series A SaaS companies?

Series A companies usually gain the most from specialized SaaS growth partners that offer month-to-month flexibility, revenue-based reporting, and proven B2B SaaS experience. This model delivers professional lead generation without the capital burden of building internal teams and still provides the transparency investors expect.

What risks come with traditional lead generation agencies?

Traditional agencies often rely on percentage-of-spend pricing that rewards higher budgets regardless of outcomes. Common issues include bait-and-switch staffing, focus on vanity metrics instead of revenue, and long contracts that reduce accountability. Many agencies also lack B2B SaaS domain knowledge needed for complex attribution and long sales cycles.

How should SaaS teams track lead generation ROI?

Teams should focus on revenue-based metrics instead of surface-level indicators. Core measures include Net New ARR, payback period under 90 days when possible, cost per sales-qualified lead, and pipeline velocity. The strongest operators track leads from first touch through closed-won revenue and adjust campaigns based on business impact.

Why do hybrid lead generation models work well for B2B SaaS?

Hybrid models combine agency speed and expertise with the control and alignment of in-house teams. They bring specialized B2B SaaS knowledge, flexible terms, revenue-focused reporting, and direct integration into existing workflows. This structure delivers enterprise-grade capabilities at startup-friendly costs while keeping accountability and transparency high.