Last updated: January 25, 2026

Key Takeaways

- Meta ads deliver strong B2B SaaS value with £22 cost-per-lead vs LinkedIn’s £64-96 and 29% ROAS. Agencies need to prioritize Net New ARR over vanity metrics to capture this value.

- Flat retainer models remove percentage-of-spend misalignment and support real performance improvements and efficient ad spend.

- Results-driven agencies connect Meta with your CRM for accurate revenue attribution and capture dark funnel buying decisions that last-click models miss.

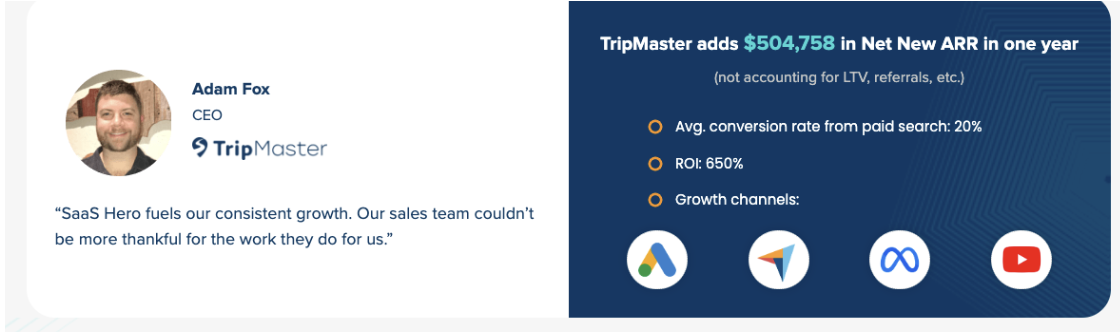

- SaaSHero backs its approach with $504K Net New ARR proof, 80-day paybacks, month-to-month contracts, and competitor conquesting for HR Tech, Transportation, and Cybersecurity SaaS.

- Teams ready to turn Facebook ads into revenue velocity can book a discovery call with SaaSHero for a performance audit tailored to their growth stage.

Executive Summary: The Revenue Alignment Framework

The strongest Facebook ads agencies for B2B SaaS follow five principles that keep incentives aligned with revenue. They use flat retainers instead of percentage-of-spend fees, bring deep B2B SaaS expertise, integrate CRM reporting, offer month-to-month contracts, and prove impact with Net New ARR case studies. This “Revenue Alignment Scorecard” separates performance partners from agencies that chase their own fee growth instead of client ARR.

Across evaluated agencies, SaaSHero shows the tightest alignment with these principles. The team combines transparent flat-fee pricing with documented results such as $504,758 in Net New ARR and 80-day payback periods for venture-backed SaaS clients.

How Facebook Ads Agencies Are Evolving Past Vanity Metrics

The Facebook ads agency market now includes boutique freelancers, generalist performance shops, and B2B SaaS specialists. B2B SaaS companies invest a median $1,468 monthly in Facebook advertising, yet many still struggle to see clear revenue impact because of weak attribution.

Traditional agencies keep misalignment in place with percentage-based fees that reward higher spend, even when performance stalls. Modern partners prefer flat retainers that disconnect their income from budget size and support honest recommendations about scaling or cutting spend. As Meta expands Account-Based Marketing tools and AI-driven creative testing, B2B SaaS teams need partners who understand the difference between lead generation for complex deals and simple e-commerce conversions.

Revenue velocity metrics now matter more than surface-level engagement. While Facebook delivers 10.63% conversion rates for B2B campaigns, the real story shows up in pipeline quality and SQL volume. Strong agencies connect HubSpot or Salesforce to Meta so teams can track Sales Qualified Leads and closed-won deals instead of just form fills.

How To Evaluate Facebook Ads Agencies For B2B SaaS

Teams choosing a Facebook ads partner should review six core dimensions that affect revenue. Fee structure alignment comes first because percentage-based models create a built-in conflict of interest. B2B SaaS specialization follows closely, since agencies must understand MRR, churn, sales cycles, and payback periods to make smart decisions.

Dark funnel attribution capabilities now sit at the center of serious B2B programs. Buyers research quietly across channels before speaking with sales, so agencies need tools that track influence beyond the last click. Contract flexibility through month-to-month agreements adds a forcing function, since agencies must earn renewals with performance instead of relying on long lock-ins.

Account-Based Marketing integration grows more valuable as Meta improves targeting for enterprise accounts. Finally, documented Net New ARR case studies show whether an agency can move revenue, not just impressions.

|

Criteria |

Traditional Agencies |

Results-Driven Partners |

Advantage |

|

Fee Structure |

10-20% of spend |

Flat monthly retainer |

Prevents spend inflation |

|

Reporting Focus |

CTR, impressions, CPC |

Net ARR, SQLs, pipeline |

Revenue-aligned metrics |

|

Contract Terms |

6-12 month lock-in |

Month-to-month flexibility |

Performance accountability |

|

Attribution |

Last-click platform data |

CRM-integrated tracking |

Clear revenue impact |

Teams that want to review their current setup can book a discovery call for a full audit of their ads performance.

Top Facebook Ads Agencies For Revenue-Focused B2B SaaS

1. SaaSHero delivers revenue-focused B2B SaaS growth with transparent flat-fee tiers from $1,250 to $7,000 monthly, based on spend bands and channel count. Case studies include $504,758 in Net New ARR for TripMaster and 80-day payback periods that supported TestGorilla’s $70M Series A. The team runs competitor conquesting campaigns that target high-intent searches such as “[Competitor] pricing” and “[Competitor] alternatives” with comparison landing pages.

HubSpot and Salesforce integrations support full-funnel revenue attribution, while month-to-month contracts keep performance front and center. SaaSHero focuses on HR Tech, Transportation, Procurement, and Cybersecurity SaaS and understands the metrics that matter to these teams.

2. GrowthSpree focuses on AI-powered tracking and campaign refinement for B2B SaaS. The agency emphasizes ICP-first targeting and persona-based messaging. Their percentage-of-spend pricing can create misalignment, and many case studies highlight SQL volume without clear Net New ARR proof. Their 6-10 week learning phase may feel long for teams that already have strong data.

3. KlientBoost brings rigorous A/B testing and creative iteration to B2B SaaS accounts. The team has strong performance marketing experience and a track record with B2B clients. Traditional contract structures may feel rigid for venture-backed startups that need more flexibility.

4. Directive Consulting focuses on enterprise B2B growth with strong ABM and account-based advertising programs. Their minimum engagement levels often exclude early-stage SaaS, and percentage-based fees may clash with capital-efficient growth plans for Series A or B companies.

5. Aimers Digital operates as a SaaS-focused boutique that understands recurring revenue and customer lifetime value. Their case studies show meaningful results. A smaller team can limit speed and scale for companies that plan rapid expansion.

|

Agency |

Fee Model |

Contract Terms |

Proven Results |

|

SaaSHero |

Flat $1,250-$7,000 |

Month-to-month |

$504K Net New ARR |

|

GrowthSpree |

Percentage of spend |

6+ months |

SQL focus, no ARR proof |

|

KlientBoost |

Percentage of spend |

6+ months |

Strong B2B SaaS results |

|

Directive |

Percentage of spend |

12+ months |

B2B growth focus |

Where Most Agencies Fall Short With B2B SaaS

The biggest risk for B2B SaaS teams comes from percentage-of-spend fee models that reward higher budgets, not better efficiency. Agencies under this structure feel pressure to push spend increases even when CAC rises and ROAS falls. This pattern inflates acquisition costs and erodes margins.

Dark funnel attribution creates a second major gap. Gartner’s 2024 Marketing Data Survey reveals 59% of CMOs believe attribution models fail to track key buyer touchpoints accurately. B2B buyers consume content across many channels before they speak with sales, so last-click models miss most of the journey. Results-driven agencies set up Conversions API and CRM tracking to connect early impressions with closed-won revenue.

When A Specialized Facebook Ads Partner Fits Best

The Bootstrap Founder Scenario. Early-stage founders running $5,000 to $10,000 in monthly ad spend gain leverage from dedicated campaign management at $1,250 monthly. This structure delivers professional campaign refinement while the founder keeps strategy in-house and avoids full agency overhead.

The VP Migration Scenario. Marketing leaders who feel stuck with vanity metrics need partners who speak in CAC, LTV, and pipeline velocity. Engagements in the $3,500 to $7,000 monthly range cover strategy and execution while reporting in the language boards and investors expect.

The Post-Funding Scaler Scenario. Series A and B companies with aggressive targets need proven playbooks such as competitor conquesting and ABM targeting. These teams must scale spend quickly while holding payback periods near 80 days to satisfy investors and protect runway.

Teams ready to turn Facebook into a revenue engine can book a discovery call and match their growth stage with the right playbook.

Conclusion: Choose Revenue Alignment Over Vanity Metrics

The 2026 ads agency landscape rewards teams that look past generic promises and shallow case studies. Revenue-focused partners stand out through flat-fee pricing, B2B SaaS specialization, CRM-level attribution, and clear Net New ARR proof. SaaSHero leads across these dimensions and aligns its economics with client growth instead of fee expansion.

The decision between traditional agencies and revenue-first partners shapes whether Facebook ads become a growth engine or a vanity expense. In a market where capital efficiency defines survival, revenue alignment becomes the obvious path.

Teams ready to prioritize revenue velocity can book a discovery call with SaaSHero and start building results-driven advertising.

Frequently Asked Questions

How should B2B SaaS companies measure Facebook ads ROI beyond vanity metrics?

B2B SaaS teams should measure Facebook ROI through Net New Annual Recurring Revenue instead of clicks or impressions. HubSpot or Salesforce integrations connect ad interactions to every stage of the funnel and then to closed-won deals. Core metrics include CAC, SQL conversion rate, pipeline velocity, and payback period. The goal is to show how each dollar of ad spend turns into predictable, recurring revenue.

Why do Facebook ads often underperform compared to LinkedIn for B2B SaaS lead generation?

Facebook often struggles in B2B SaaS because of targeting limits and lead quality gaps, not because the platform lacks power. Facebook usually delivers cheaper leads at about £22 per lead, while LinkedIn ranges from £64 to £96. LinkedIn often wins on intent and SQL conversion because of its professional context and job title targeting. Facebook works best for awareness, education, and retargeting within multi-touch journeys.

What contract terms should B2B SaaS companies demand from Facebook ads agencies?

B2B SaaS teams should push for month-to-month agreements that keep both sides accountable. Long contracts of 6 to 12 months shift risk to the client and reduce pressure on the agency to perform. Flat-fee retainers avoid the conflict that comes with percentage-of-spend pricing. Teams should also require revenue-focused reporting that highlights Net New ARR, SQLs, and pipeline contribution instead of impressions and CTR.

How can B2B SaaS companies overcome Facebook’s attribution challenges in complex sales cycles?

Teams can reduce Facebook attribution gaps by implementing Conversions API and CRM-level tracking that connects ad engagement to revenue. Dark funnel behavior means most B2B research happens outside direct tracking, so first-party data becomes essential. Use UTM parameters, campaign-specific landing pages, and detailed lead source fields in the CRM. Combine platform data with branded search trends, direct traffic, and sales feedback to understand Facebook’s real impact.

What budget levels justify hiring a specialized Facebook ads agency for B2B SaaS?

B2B SaaS companies usually justify a specialized agency once Facebook spend reaches $5,000 per month, with a strong fit around $10,000 and above. Below that level, fees can outweigh the value of optimization. Early-stage teams can still benefit from focused campaign management at about $1,250 monthly for budgets up to $10,000. As a rule of thumb, agency fees should sit between 10 and 25 percent of total ad spend while driving clear gains in CAC and SQL volume.