Key Takeaways

- Transparent pricing models like tiered flat retainers replace percentage-of-spend structures and remove conflicts of interest in construction software marketing.

- Five pricing models dominate 2026: tiered retainers, project-based, performance-based, hourly, and hybrids, evaluated on transparency, alignment, flexibility, and industry fit.

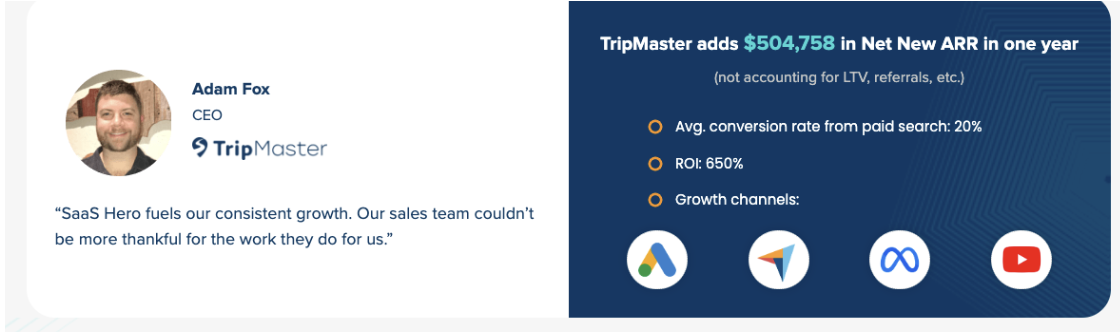

- SaaSHero fixed monthly retainers deliver 40-60% cost savings over percentage models at higher ad spends, with a proven 650% ROI for B2B SaaS clients.

- Construction tech requires vertical expertise, so prioritize agencies with month-to-month terms, revenue-focused reporting, and no hidden fees.

- Construction SaaS teams ready for transparent pricing can schedule a discovery call with SaaSHero today.

Core Pricing Models for Construction Software Marketing

Five primary pricing models shape construction software marketing in 2026.

- Tiered flat retainers: Fixed monthly fees based on ad spend bands

- Project-based pricing: One-time fees for specific deliverables

- Performance-based models: Compensation tied to revenue outcomes

- Hourly consulting: Time-based billing that often limits scalability

- Hybrid structures: Flat fees combined with performance bonuses

The evaluation framework uses four criteria. Transparency covers how clearly the agency explains costs. Alignment measures whether incentives match client revenue goals. Flexibility reflects how easily the model scales or adjusts. Construction industry fit depends on vertical expertise and understanding of construction workflows.

Construction Software Agency Landscape in 2026

The construction software marketing landscape splits between generalist agencies and specialists focused on construction tech. Leading construction software players, including Procore, Bentley Systems, and others, now favor agencies with deep vertical expertise instead of broad digital capabilities.

Traditional agencies usually charge 15-20% of ad spend and require 6-12 month contracts. Modern alternatives favor month-to-month agreements and flat retainers that remove the conflict of interest created by percentage-based billing.

Key Construction Tech Marketing Trends for 2026

AI-powered attribution and competitor conquesting now sit at the center of construction tech marketing. Vertical SaaS in construction commands higher prices due to niche needs, so agencies must show real knowledge of construction workflows, project management cycles, and industry-specific pain points.

Build In-House or Hire a Construction SaaS Agency

Construction software companies must choose between building internal marketing teams or partnering with specialized agencies. Internal teams provide control and institutional knowledge but require heavy hiring and training investments. Agencies offer immediate expertise and proven playbooks, yet they differ widely in pricing transparency and construction industry depth.

|

Spend Band |

SaaSHero Dedicated Manager |

SaaSHero Full Team |

Traditional Agency (15% of spend) |

|

Up to $10k |

$1,250/mo |

$2,500/mo |

$1,500/mo |

|

$10k – $25k |

$1,750/mo |

$3,000/mo |

$2,625/mo |

|

$25k – $50k |

$2,250/mo |

$3,500/mo |

$5,625/mo |

|

$50k+ |

$3,250/mo |

$4,500/mo |

$7,500/mo+ |

The transparency advantage grows at higher spend levels. Percentage-based models can cost two to three times more than flat retainers and create incentives that favor higher budgets instead of efficient performance.

Modern Pricing Approaches and Where SaaSHero Fits

Modern construction software marketing agencies rely on several pricing models, and each model serves different stages of construction tech growth.

Tiered Retainers for Construction SaaS Growth

B2B SaaS agencies typically structure monthly retainers from $3K-$15K based on growth stage, and construction-focused agencies often charge premium rates because of vertical specialization.

Flat-Fee Marketing Agencies in 2026

Flat fees remain relevant at 32% among SaaS providers’ pricing metrics, and this predictability helps construction companies plan budgets and forecast cash flow with confidence.

Why SaaSHero Works for Construction Tech Marketing

- Vertical expertise: Deep understanding of B2B SaaS buyer journeys, construction software verticals, and competitive landscapes

- Transparent pricing: Fixed monthly retainers that remove percentage-based conflicts of interest

- Month-to-month flexibility: No long-term contracts, which reduces risk for B2B SaaS companies

- Revenue focus: Reporting centered on Net New ARR instead of vanity metrics

- Proven results: 650% ROI and $504k ARR growth across B2B SaaS clients including transit and HR tech

|

Model |

Transparency |

Alignment |

Flexibility |

B2B SaaS Fit |

|

Tiered Retainers |

High |

High |

Medium |

High |

|

Percentage-based |

Low |

Low |

Low |

Low |

|

Project-based |

High |

Medium |

High |

Medium |

|

Performance-based |

Medium |

High |

Low |

Medium |

|

Hourly Consulting |

High |

Low |

High |

Low |

Teams that want a transparent pricing model for B2B SaaS marketing can book a discovery call and see how tiered retainers improve marketing ROI.

Readiness Checklist and Common Pricing Pitfalls

Construction software companies should assess marketing maturity before choosing an agency pricing model. Key readiness indicators include the following items.

- Clear definition of target customer segments and buyer personas

- Established tracking between marketing activities and revenue outcomes

- Realistic budget allocation based on customer acquisition cost targets

- Internal alignment on growth objectives and timeline expectations

Construction Software Pricing Traps to Avoid

Common pitfalls include bait-and-switch tactics where agencies quote low percentages and then add hidden fees. Other risks include vanity metric reporting that hides real performance and long-term contracts that lock in underperforming partners. Construction companies should request transparent reporting on pipeline value and closed-won revenue instead of clicks and impressions.

A $1,250 per month pilot with month-to-month terms gives construction software companies a way to test agency performance without heavy financial risk or long commitments.

Real-World Construction SaaS Scenarios

Bootstrapped Construction Startup ($10k monthly spend): The founder-led team needs professional campaign management without enterprise-level costs. A dedicated manager model delivers expertise at a predictable monthly cost.

Frustrated VP of Marketing ($50k monthly spend): The current agency reports vanity metrics while the board demands pipeline accountability. A full team model provides revenue-focused reporting and strategic guidance.

Post-Funding Construction Scaler: A Series A company needs rapid market penetration with efficient spending. Transparent pricing supports confident budget allocation against aggressive growth targets.

Conclusion and Next Steps for Construction SaaS Leaders

Transparent pricing models for B2B SaaS marketing mark a shift away from percentage-based structures toward revenue-aligned partnerships. Tiered flat retainers remove conflicts of interest and create predictable costs that B2B SaaS companies can budget and scale with confidence.

Evidence favors transparent pricing models that align agency incentives with client success instead of ad spend volume. B2B SaaS companies that want sustainable growth should favor agencies that offer month-to-month agreements, fixed retainers, and revenue-focused reporting.

Teams ready to roll out transparent pricing for B2B SaaS marketing can book a discovery call with SaaSHero and explore how this B2B SaaS-focused approach supports 2026 growth goals.

Frequently Asked Questions

What are transparent pricing models for construction software marketing?

Transparent pricing models provide clear, upfront cost structures without hidden fees or percentage-based markups. For construction software marketing, this usually means tiered flat retainers based on ad spend bands instead of percentage-of-spend models. These structures help construction tech companies predict marketing costs and keep agency incentives tied to client success instead of budget inflation.

How do Buildertrend agency costs compare to transparent pricing alternatives?

Traditional agencies that serve construction software companies like Buildertrend usually charge 15-20% of ad spend plus setup fees and long-term contracts. For a $30k monthly budget, that range equals $4,500-$6,000 each month plus extra costs. Transparent alternatives such as tiered retainers cap costs at fixed amounts regardless of spend swings, often delivering 40-60% cost savings at higher spend levels while removing conflicts of interest.

What are the benefits of tiered retainers for construction SaaS companies?

Tiered retainers create predictable monthly costs that scale with business growth instead of ad spend volatility. Construction SaaS companies gain aligned incentives where agencies focus on efficiency and results instead of budget maximization. The structure also supports better financial planning and removes the risk that agencies will push unnecessary budget increases to raise their percentage-based fees.

How do flat-fee marketing agencies perform compared to percentage-based models in 2026?

Flat-fee agencies show stronger performance metrics such as higher conversion rates, lower customer acquisition costs, and better return on ad spend. The incentive structure encourages agencies to improve efficiency instead of chasing volume, which produces more strategic campaign management and sustainable growth for construction software companies.

What should construction tech companies look for in transparent pricing model agencies?

Construction tech companies should look for agencies that offer month-to-month agreements, clear retainer structures with no hidden fees, and vertical expertise in construction software. They should also expect revenue-focused reporting that tracks pipeline value and closed-won deals. The agency needs to show a strong grasp of construction buyer journeys, competitive landscapes, and the adoption challenges that shape construction technology decisions.